The crypto market has been extremely hot recently, especially the price of DeFi tokens have been pumping every day. Did you also get a good harvest?

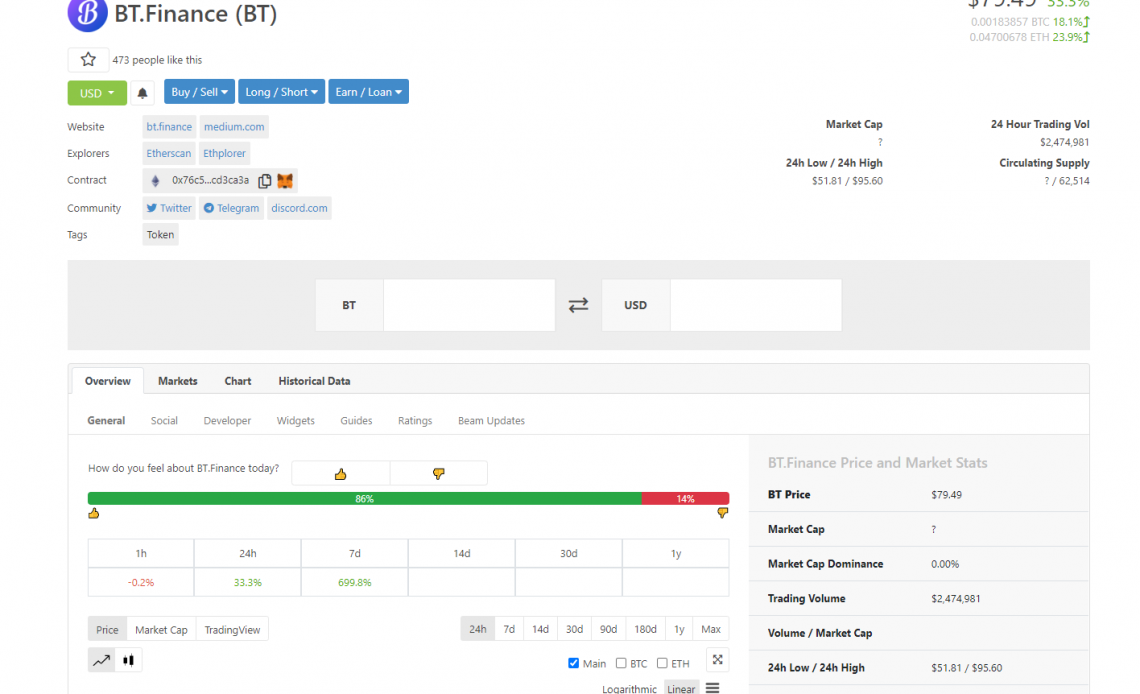

In the past few days, $BT token has been becoming a new star in DeFi with it’s 10X rising in 24 hours. However many people may not be familiar with it, so what is BT.Finance?

BT.Finance is a smart DeFi yield aggregator based on the ethereum ecosystem, targeting the best and sustainable yield for tokens.

Compared with YFI or many other aggregators, what are the advantages of BT.Finance?

How does it bring the best and sustainable yield for tokens?

Here we can find some hints:

1.Audited by @peckshield.

2.@CoverProtocol Insurance, Insurance fund for users besides audit.

3.Gnosis safe multi-sig governance.

4.Set Timelock.

5.Auto harvest from other excellent DeFi yield aggregators and platforms.

6.Blockchain and securities industry senior experts serve as project consultants and strategists

The Vault is divided into 3 pools as Stable Profits Pools, High Yield Pools and Smart Hybrid Pools to all users with various risk tolerances.

The BT Vault v1 is to earn $CRV $Sushi $BAS $MIS $pickle tokens from Pickle.finance. Earn $CRV $1INCH $SUSHI $BADGER $LDO from other Platforms, Meanwhile all yields are long-term and sustainable.

The below is its Stable Profits Pool overview:

What is the economic model of BT tokens?

BT token is the governance token for BT.Finance. 20% of yield farming revenue will be used to buy back $BT.

The max supply of 270,000 BT tokens will be completely distributed with no pre-mining, no pre-sale, and no mint.

- 210,000 Yield Farming

- 40,000 Dev Fund(Simultaneously Releasing with Minning)

- 10,000 Gov Fund ( Security Audit, Insurance Fund, And Others)

- 10,000 Operations

Emission: with a 2.7% reduction from the prior week until week 105. Here we can check the emission table for details.

So now, do you think BT is underestimated?

How to start your earning in BT Finance?

There are 2 types of staking pools you can choose – Stable Profits Pools and High Yield Pools.

Stable Profits Pools

Take USDC for example.

- Choose USDC and choose the amount you want to transfer, and then click the approve button.

- Choose the amount you want to stake and click the Deposit & Stake Button.

- Go through the steps in your wallet

- Staked successfully

- You can find your real-time staking rewards in the dashboard

- You can claim rewards, or you can withdraw your assets anytime, just click the Unstake button.

What about Staking in High Yield Pools?

- First, you need to get your SLP in Sushiswap or Zapper first. Search SUSHI and choose the USDC/ETH, and click Add Liquidity.

- Connect your wallet and then add the amount you wanted in the blank and confirm.

- Farm On BT.Finance. Now back to the BT. Finance, you can check the balance of the USDC-ETH SLP on the homepage.

- Choose your wanted amount to deposit and stake.

- Then you can check your rewards in the dashboard.

Thousands of $BT will be airdropped to its farmers in March!

More info from Click Here

BT Token Contract: 0x76c5449F4950f6338A393F53CdA8b53B0cd3Ca3a

Join: BT.Finance

Twitter: Click Here

Telegram: Click Here

Discord: Click Here