BlackRock’s proposed spot Bitcoin ETF, the iShares Bitcoin Trust, has been listed by the Depository Trust and Clearing Corporation (DTCC) under the ticker IBTC. Although the U.S. Securities and Exchange Commission (SEC) is yet to give its nod of approval, this move suggests that the world’s largest asset manager is gearing up for a potential launch.

Eric Balchunas, a senior ETF analyst from Bloomberg, highlighted the importance of this event in a thread, pointing out that this is the first spot ETF of its kind to be listed on DTCC.

The iShares Bitcoin Trust has been listed on the DTCC (Depository Trust & Clearing Corporation, which clears NASDAQ trades). And the ticker will be $IBTC. Again all part of the process of bringing ETF to market.. h/t @martypartymusic pic.twitter.com/8PQP3h2yW0

— Eric Balchunas (@EricBalchunas) October 23, 2023

The move by BlackRock to get its logistics in order, such as seeding and having a ticker in place, may indicate they anticipate imminent approval from the SEC.

However, the iShares Bitcoin Trust is not alone in the waiting room. Nearly 12 other spot Bitcoin ETFs are in line for SEC approval, with companies such as Grayscale Investments, Fidelity, and WisdomTree having already filed their applications.

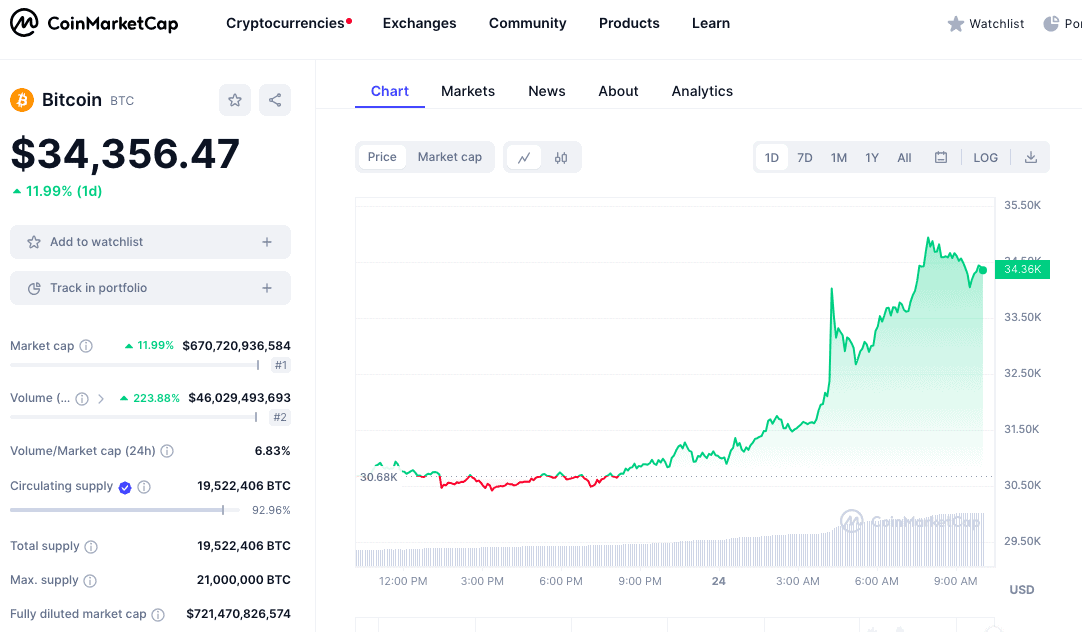

Bitcoin has been experiencing a notable price surge, with a 12.6% rise in the last 24 hours, reaching a peak of $34,942, its highest in over a year. The cryptocurrency world is abuzz with optimism that the awaited approval for a spot Bitcoin ETF might be closer than anticipated.

The DTCC, which is instrumental in the U.S. financial landscape, deals with a staggering $2.3 quadrillion worth of stock sales every year. The listing of BlackRock’s ETF on such a major platform emphasizes the ETF’s potential impact on the market.

Just last week, there were reports about BlackRock’s latest application amendment hinting at a seed investor ready to fund the product this month. Although the exact date has been withheld, the amendment suggests that the investor intends to purchase shares in October. Typically, seed capital investors play a crucial role in kickstarting an ETF by ensuring it gets listed and traded on stock exchanges.

BlackRock’s recent move has rekindled hope among experts that a Bitcoin ETF might soon see the light of day. Some analysts from Bloomberg Intelligence even predict a 90% likelihood of a Bitcoin ETF getting the green signal in January.

It’s worth noting that while the SEC has given a thumbs up to Bitcoin futures ETFs, spot products have not received the same response. However, the entry of industry heavyweights like BlackRock into the Bitcoin ETF arena suggests that the tide may be turning.

Summary:

- BlackRock’s iShares Bitcoin Trust, a proposed spot Bitcoin ETF, has been listed by the Depository Trust and Clearing Corporation (DTCC) under the ticker IBTC, indicating preparations for a potential launch.

- While awaiting SEC approval, Bitcoin’s price has surged, reflecting optimism in the market about the possible approval of spot Bitcoin ETFs.

- BlackRock’s application amendment hints at a seed investor planning to fund the product in October, fueling speculation about an imminent ETF launch.