Jump Ahead To:

The Limitations of Uniswap

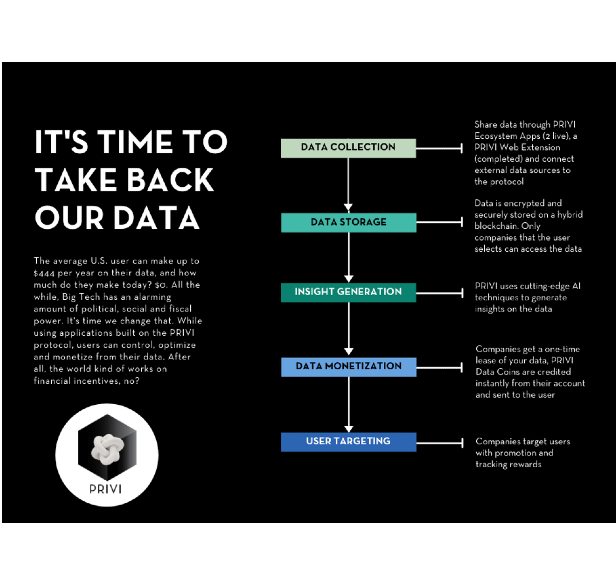

The PRIVI Protocol aims to provide an enhanced alternative to systems like Uniswap and crypto-based swapping. By aiming to provide real-world use cases for swapping, the industry moves beyond the limitations of cryptocurrency pair swapping.

Platforms like Uniswap have become popular in recent months as they offer users of crypto upgraded use cases for their crypto. However, these platforms still have limited use cases. One of them is that they limit the total value of tokens that can be swapped to the size of the crypto market. The entire crypto market is worth a few hundred billion. That figure is huge but still minuscule in proportion to the global economy.

Another limitation of Uniswap and the like is that not everyone is interested in crypto-to- crypto swapping. Most people in the world do not engage in crypto. However, most people have a lot of value locked inside future return events, like loans.

The PRIVI Protocol thus aims to open up an unbounded interest and swapping environment that is more attractive for all people, not just crypto users. By combining blockchain swapping with real world use cases, like loans.

This type of swap is what we call use-case-based swapping, and it could be the next step in swapping. When someone performs an ETH/BTC swap, the swap is not dependent on the performance of the activity. Instead, it is limited to what the market dictates. However, use- case based swapping is dependent on real-world performance.

The next-stage of crypto swapping

With this model, the opportunities could be endless. Loans perform in a variety of ways. Interest could be frequent and small, infrequent and large, or late altogether. PRIVI Use Case Swapping allows users to solicit collateralized loans from other users. In return, these users receive tokens that are tied to the performance of that use case. If the user pays their interest on time, the value of those tokens could rise, if they are missing the interest payments, the value of the tokens could decrease.

These tokens that the lenders receive can be swapped for internal currencies in the PRIVI system. These can be other tokens, which perhaps are performing better, or exchanged for other currencies so the lender can liquidate. This ensures that lent funds are never locked. In traditional finance, if you loan someone money you generally are unable to use that money, instead receiving interest and the principle when time expires. But with PRIVI Use Case Swapping, you can loan someone money and in return receive tokens that allow you to continue to earn interest, swap for other tokens to potentially earn more interest, or liquidate whenever you want. To learn more about our innovative and novel swapping technologies, see our Lightpaper .