BarnBridge DAO, a decentralized autonomous organization focused on risk management in the decentralized finance (DeFi) space, has halted all work on its protocol following reports of an investigation by the United States Securities and Exchange Commission (SEC). In a recent post on the project’s Discord channel, Douglas Park, a lawyer representing BarnBridge DAO, informed members about the SEC’s probe into the organization and individuals associated with it. To mitigate potential legal liabilities, Park advised suspending all activities related to BarnBridge, including closing liquidity pools and refraining from receiving compensation for work tied to the DAO’s investments.

For those who do not know, BarnBridge is an open-source, decentralized protocol founded in 2019 and launched in September 2020. It serves as a DeFi lego, allowing users to tokenize risks and create tradeable tokens linked to market volatility. With BarnBridge v2, users can earn a fixed return on their deposits by exchanging variable APYs from money markets for a fixed APY, providing innovative solutions for yield and credit in the DeFi space. BOND is the native token of BarnBridge.

Co-founder Tyler Ward, known as “Lord Tyler” on Discord, confirmed the authenticity of Park’s message on the BarnBridge Discord channel. However, neither Park nor Ward provided details regarding the reason behind the SEC’s investigation. Park explained that due to the ongoing and non-public nature of the probe, only limited information could be shared at this time.

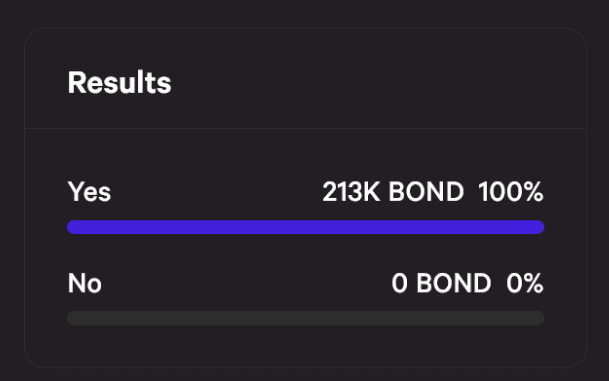

Interestingly, prior to the SEC investigation becoming public, BarnBridge token holders had voted to retain the law firm Park & Dibadj LLP, led by Park, as legal counsel for the DAO. The proposal received overwhelming support, with 94.3% of the votes in favor.

This suggests that the SEC’s investigation might have commenced before June 30, prompting speculation among some DAO members. One member expressed doubts about the SEC’s investigation and suggested that BarnBridge’s founders might be using it as an excuse for an “exit strategy” to potentially defraud investors. Ward dismissed this claim, stating that it would be a poorly planned attempt to deceive investors.

— BarnBridge (@Barn_Bridge) July 7, 2023

While some DAO members took a lighthearted approach to the situation, making jokes and suggesting ways to avoid the SEC’s reach, the news has had an impact on the price of BarnBridge’s native token, BOND. Since the news broke, the token’s price has fallen 6.9% to $3.05, according to CoinGecko. BOND’s price has experienced a significant decline of 98.5% from its all-time high of $185.7 on October 27, 2020, and it currently has a market capitalization of $28.32 million.

This investigation into BarnBridge DAO by the SEC comes on the heels of recent lawsuits filed by the regulatory agency against major cryptocurrency exchanges Binance and Coinbase, accusing them of offering unregistered securities. The fact that the SEC is now targeting a smaller to mid-sized DAO like BarnBridge suggests that it is widening its scrutiny beyond the industry’s largest players.

The outcome of the SEC investigation and its implications for BarnBridge DAO and its community remain uncertain, as further details have yet to be disclosed.