June 5, 2023: In a major legal development, the U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Binance, one of the world’s largest cryptocurrency exchanges, in the U.S. District Court. The regulatory body accuses Binance of conducting unregistered securities operations and operating illegally within the United States.

The SEC claims that Binance failed to comply with the necessary registration requirements to function as a securities exchange. Furthermore, the lawsuit points out specific features offered by Binance, such as BNB, Simple Earn, and BNB Vault, which the regulator classifies as investment schemes and alleges were not appropriately registered.

One notable accusation within the lawsuit is the claim that Binance’s CEO, Changpeng Zhao (CZ), deliberately evaded registration despite being aware of the regulatory rules. The SEC asserts that CZ, on occasion, transferred billions of dollars’ worth of user funds into Merit Peak, an entity under his control in the United States. Additionally, the lawsuit suggests that CZ transferred these assets to third parties.

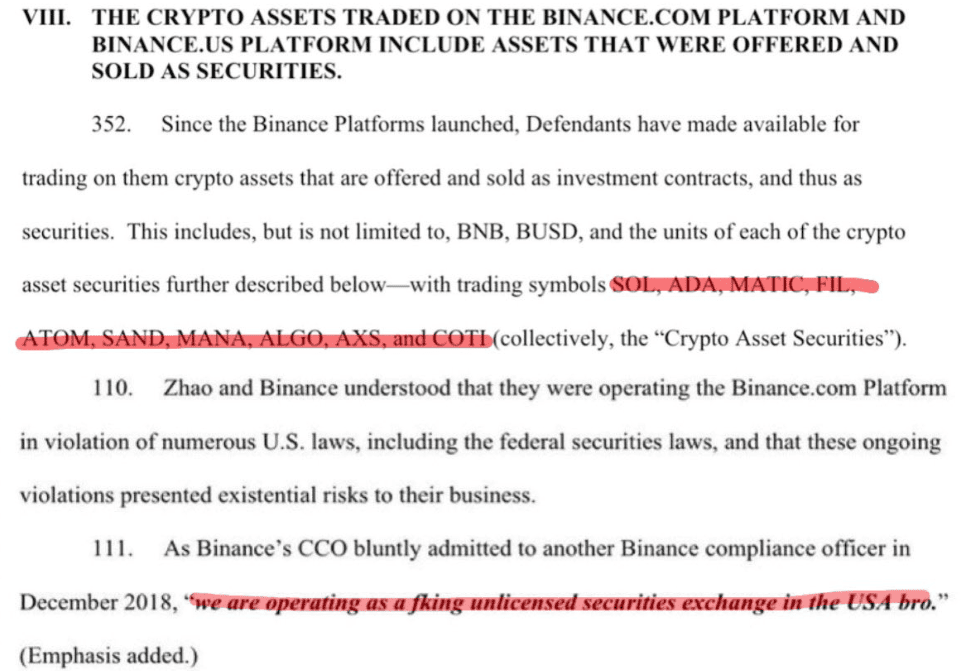

The U.S. Securities and Exchange Commission (SEC) has made claims stating that crypto assets such as SOL, ADA, MATIC, FIL, ATOM, SAND, and others should be considered securities. Furthermore, the SEC has brought attention to a statement made by the former COO of Binance in 2018, allegedly admitting,

We are operating an unlicensed securities exchange in the USA, bro.

Following the news of the lawsuit, the price of Bitcoin experienced an immediate decline of 4%. BNB and Sol is down by more than 10%.

Despite the legal action taken by the SEC, CZ expressed confidence in Binance’s stability and assured users that the platform’s systems, including withdrawals and deposits, were operating normally.

CZ also mentioned that Binance would issue a response once they had received and reviewed the complaint, emphasizing that they had not seen it yet.

4.

Our team is all standing by, ensuring systems are stable, including withdrawals, and deposits.

We will issue a response once we see the complaint. Haven’t seen it yet. Media gets the info before we do.

— CZ

Binance (@cz_binance) June 5, 2023

Edit: Binance filed a response on their official site: Read now

If the SEC’s lawsuit is successful, it seeks to prohibit Binance from engaging in any activities related to cryptocurrencies, acting as a broker dealer or clearing agency. The regulatory body also aims to obtain disgorgement of ill-gotten gains, civil monetary penalties, and equitable relief, which could potentially involve significant fines.

Also read: Binance’s market share plummets – What went wrong?

As the legal proceedings unfold, the outcome of the SEC’s lawsuit against Binance will undoubtedly have substantial implications for the cryptocurrency industry, regulatory compliance, and the future of Binance as a major player in the market.

Disclaimer: This news article is based on the information available at the time of writing and may be subject to changes or updates as more details emerge.